Life Insurance

Life insurance is a crucial step in planning for your future and your family’s future. It can fulfill promises and obligations to your family if you are no longer living.

The cost of not having life insurance to help to alleviate the financial stress and burden of the loss of a loved one in your family is next to impossible to calculate. Realizing the importance of life insurance shouldn’t come at the worst time – when you need it. What would the impact be on your financial stability if you or your spouse weren’t here tomorrow?

Usually, a life change motivates people to consider the importance of life insurance such as marriage, buying a home, having a baby, and a separation or divorce.

Reasons to Buy Life Insurance

- Final expenses: Funeral, taxes, debt repayments such as mortgage, loans, credit card balances, lines of credit, etc.

- Loss of an income: Sole breadwinner or even half of the income equation for your family

- Not being able to continue the savings plans or retirement plans currently in place.

- Education plans for your children

Business Owners

Business owners may put policies in place if they plan on passing the business on to their children. By giving the children enough to pay for the taxes that they could expect to pay. This saves the business from being sold at a really low price because the children or spouse were forced to sell.

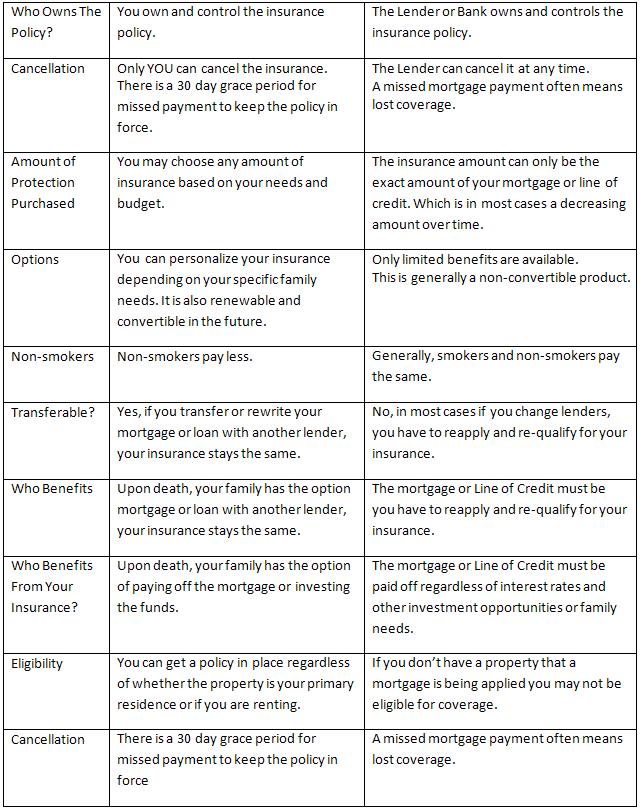

Personal Insurance vs. Mortgage Insurance

To clarify some common misconceptions about the differences between personally owned life insurance products and what you are paying for with your lender / mortgage insurance. Mortgage life insurance was created to protect the repayment of a mortgage. If the policy holder dies the bank would receive the death benefit which would cover the repayment of the mortgage to the bank. Personal life insurance is a policy which protects your beneficiary with a death benefit that they can consequently choose how to address financial needs and the freedom to do what they need to deal with the financial stress that can accompany the loss of a loved one. Here are some of the main differences:

The information presented above could similarly apply to other products like Critical Illness Insurance or Disability Insurance. You may also have other insurance that is just like “Mortgage or Lender Mortgage Insurance” but it is disguised as something else. If you have:

- Credit Card Life Insurance

- Life insurance through your professional association

- Optional life insurance at work (what are the benefits & are they enough?)

- “Special offer” life insurance

- “TV offer” life insurance

Types of Life Insurance

- Whole LIfe Insurance

- Universal Life Insurance

- Disability Insurance

- Critical Illness